As banks turn backs on outback towns, locals must pay for the privilege

A regional banking taskforce is looking at the problem of rural bank closures but it may be too late for some of Queensland’s outback towns.

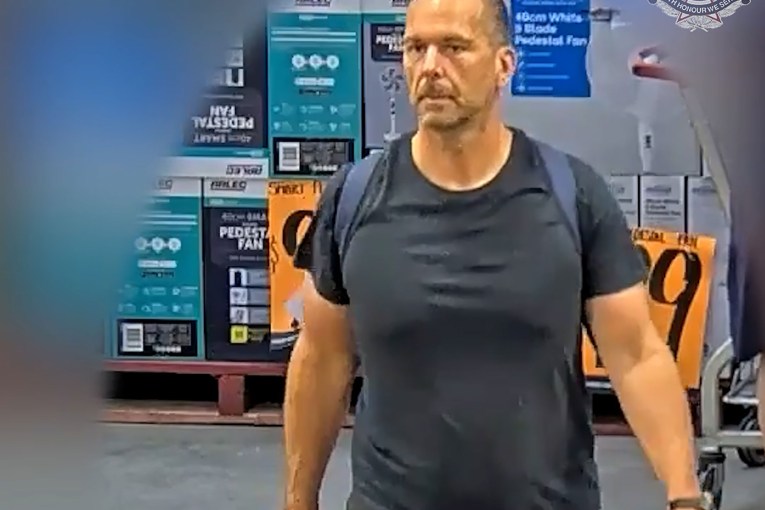

Murweh Shire Mayor Shaun Radnedge says locals are outraged at their treatment by big banks. (Photo: Malcolm Roberts)

Charleville and Longreach have already learned they are losing their Suncorp Bank branches come February.

And their community leaders can’t understand why, given the State’s outback is now seeing a resurgence and with borders opening, they expect hordes of tourists to head their way.

Local MP, Robbie Katter, says there is market failure in the regional banking sector leading to postcode discrimination, branch closures and a reduced appetite to lend to people in bush towns.

The Western Queensland Alliance of Councils is also looking into why, in some areas, borrowers need a bigger deposit than in other areas.

Murweh Shire Council Mayor, Shaun Radnedge, whose council encompasses Charleville, says it is disappointing that towns like his are trying to encourage investment and keep young people in the district, but they face discrimination.

“We want to attract people who want to invest in our areas. Why do you need a bigger deposit if you are willing to move to Charleville or somewhere like that?” Radnedge said.

And three weeks ago he, like other Suncorp customers in the town, received an email telling them the Suncorp branch was closing.

“It is very disappointing for a corporation to make a corporate decision to pull out of a regional area that is actually going ahead,” he said.

Radnedge and the council will be expressing their disappointment during a phone hook-up with the Suncorp CEO in mid January but they don’t expect anything to change.

Radnedge says there is a desperate need for a rural bank to fill the void.

“Our next step is to find a solution to fill that gap and as a progressive council and progressive community we would rather, instead of dwelling on the negative, we would rather move to the positive.”

Longreach Mayor Tony Rayner said Suncorp had advised it was closing its branch there but retaining the agri-business arm and the ATM.

“We are disappointed yet again that we are losing another bank effectively. I know it is a reflection of online banking and the loss of foot traffic going into the branches but for those people who like to walk in and deposit cash and get a cash float, it is a bit frustrating,” Rayner said.

Charleville and Longreach retain several of the big four banks.

Katter, Traeger MP and Leader of Katter’s Australian Party, said there was a growing onus on governments to intervene.

“For many years not only have the banks been departing from their bricks and mortar but also their obligation to provide loans in these rural towns,” Katter told InQueensland.

“It is now well acknowledged that postcode discrimination exists from all major lenders and trying to get a loan in Charleville is dramatically more prohibitive than Townsville or Brisbane – these decisions are driven by postcode and are often no reflection on the suitability for an applicant’s security for a loan.”

Katter said loan applicants in rural and regional areas face more stringent lending criteria.

“In rural areas it is not uncommon for loan to value ratios (LVRs) to move from 10 to 50 per cent for a house, meaning instead of a 10 per cent deposit you need 50 per cent upfront.”

He said a government owned or backed bank was an answer.

Data from the Australian Prudential Regulation Authority shows that in the past four years, the number of banks outside major cities has fallen from 2471 to 1896.

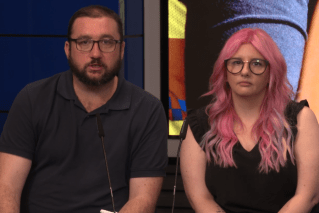

Michael Sukkar, Assistant Treasurer and co-chair of the Federal Government’s Regional Banking Taskforce, said there could be a role for some level of support at a local, state or federal level.

“I think in this process, we’re highlighting very clearly what the problems are, what the community expectation is and allowing the banks to draw their conclusions on what the solutions should be. But, if necessary, we will push them in whichever direction they need to go,” Sukkar said.

“I think there’s a lot of pressure being put on them. I congratulate and thank the banks for being involved but I don’t think there’s any doubt that this is a process that has probably assured they’re a little bit out of their comfort zone. That’s healthy and that’s what the purpose of the taskforce is.

“I think they would say that this wasn’t their idea, this was our idea. So I think they’re constructively engaging with the taskforce, we’re grateful to them for that. But would it have been their decision and their choice? I doubt it.”