Farmers set for a bountiful year with drought and trade tensions easing

Most Australian farmers are set for a profitable year with the rebound from drought set to outweigh coronavirus and trade tensions with China.

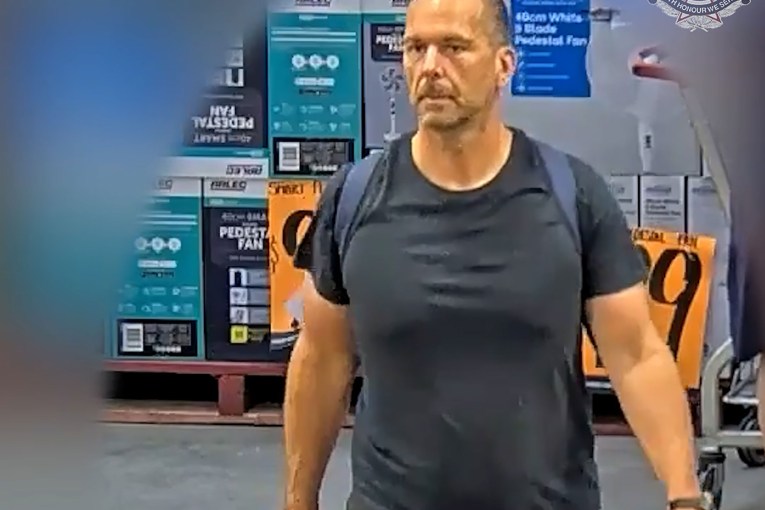

Vanstone Produce managing director Justin Vanstone on his family farm near Gatton. (Photo: Ausveg)

Rabobank’s annual agribusiness outlook report released on Friday found high commodity prices, good weather and low interest rates will underpin financial gains.

A generally profitable season will kick-start recovery from severe drought and position agriculture to fight headwinds including the pandemic and reducing reliance of China.

The report’s lead author Tim Hunt said global demand for food and other farm produce remained surprisingly firm despite a turbulent environment across the world.

“In a current global environment marked by the pandemic, political tensions and trade wars, demand for food and agricultural products has remained unexpectedly strong,” Hunt said.

The report found the sector is taking a hit globally from the pandemic and association lockdowns.

Turbulence is also being caused by the emergence of the United States from Donald Trump’s tumultuous presidency and continuing trade wars.

“Market intervention is back in vogue, with grain-exporting countries reconsidering export quotas and taxes as they fret over food security, while elsewhere port strikes have impeded trade flows,” the report says.

But the weather has turned in the favour of Australia farmers, with Rabobank declaring Mother Nature had dealt the country a winning hand.

Last year’s above-average rainfall set up a strong winter crop, significantly increasing storage across the Murray-Darling Basin and high moisture to open this year.

“This is improving broadacre farm incomes, boosting locally grown feed and underpinning better water allocations for irrigators,” Hunt said.

The La Nina climate cycle has also rendered large parts of the US, Latin America and eastern Europe unusually dry, helping to drive up prices and tighten international markets.

Australian farmers enter 2021 with barley, wine and timber exports to China effectively blocked, while informal barriers are constraining cotton and lobsters.

The report found November’s shipments to China fell 33 per cent below the previous year.

Hunt said many products were still flowing to China with $800 million worth shipped to China in November and preliminary data showing strong wheat exports in December.

“2021 will likely mark a watershed year, in which Australia starts to reduce its reliance on China, voluntarily or otherwise,” he said.

Reducing Australian agriculture’s reliance on the Chinese market is highlighted as one of three major transitions for the sector in 2021.

Pandemic recovery and adjusting to a market increasingly looking for sustainable produce will also be key challenges.

The report also warns of a delicate transition as governments withdraw coronavirus support measures which have propped up demand for food and fibre.

“If this is messed up, we could easily see demand for food and agricultural products soften during this transition,” Mr Hunt said.

He said changes to agriculture through an increased focus on climate change mitigation could be the most significant transition the sector faces.

RABOBANK’S COMMODITY OUTLOOK FOR 2021

* Wheat – Strong global demand to keep prices firm through the year

* Beef – Rebuild year with favourable conditions triggering increased breeding numbers, and reduced slaughter keeping cattle prices firm

* Lamb – Prices will remain strong but fall short of recent record levels given weaker demand and increasing animal numbers

* Wool – Expecting recovery in global consumer demand to lift wool prices

* Dairy – Strong cause for optimism that profitable market settings will extend into the 2021/22 season

* Sugar – A balanced global supply outlook is met with significant risks including La Niña, trade flows and coronavirus

* Cotton – Production set for sharp recovery as demand recovers post-coronavirus

* Wine – COVID-19 disruptions to hospitality will continue to underpin retail demand but Australia’s tensions with China will pressure average export prices

* Horticulture – Strong demand in key markets but coronavirus disruptions and geopolitical tensions to take the shine off

(Source: Rabobank Agribusiness Outlook 2021)