Blackall’s shear optimism: Outback mayor pins town revival on spinning a yarn

A Central Queensland mayor wants $190 million to build a wool-milling complex of international scale that will boost jobs in the region and loosen China’s grip on the trade.

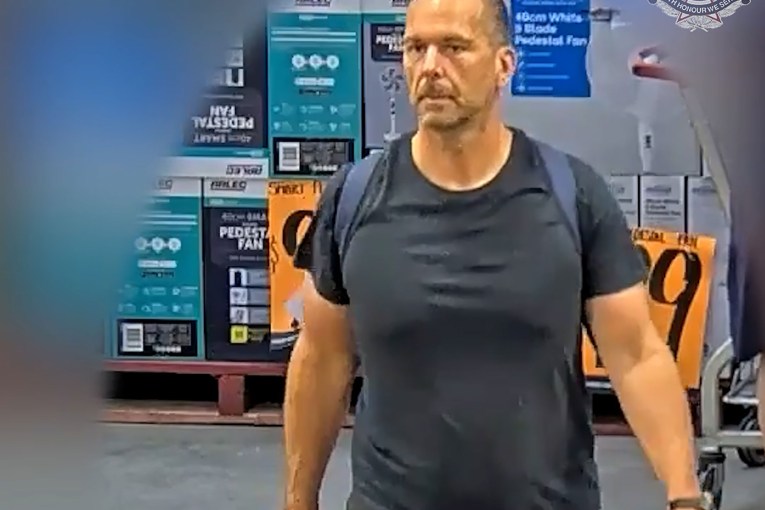

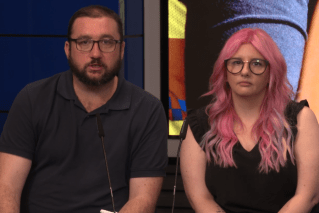

Cr Andrew Martin with his wife Louise wants wool production to return to Blackall. (Photo: Sally Cripps, courtesy of Queensland Country Life).

China’s continuing trade and diplomatic spat with Australia has added a sense of urgency to a proposal from Blackall-Tambo Council to build Australia’s largest wool scour and milling facility in the State’s central-west.

That’s the view of local Mayor Andrew “Marto” Martin, a fourth-generation wool producer and “eternal optimist” who believes his region needs to play to its strengths to shore up its future.

One of those assets lies beneath the ground – the region’s hot Artesian bore water that’s widely acclaimed as one of the world’s best resources for cleaning, or scouring greasy wool once shorn off the sheep’s back.

Blackall, about 1000 km north-west of Brisbane, is already home to the historic wool scour, built in 1908 but closed 70 years later – Australia’s last remaining steam operated wool washing plant – before being revived as a tourist attraction in 2002.

Martin’s proposal is far more ambitious, aiming to process more than 10 million kilograms annually, accounting for about an eighth of Australia’s total wool clip this year.

Of the total volumes produced in Australia, Queensland grows the smallest portion of all the mainland states.

On Martin’s calculations, the facility would need 75 megalitres of water annually, occupying a 250 square metre by 1000 square metre space.

In return, Martin is estimating the project will directly generate 278 full time jobs. He’s also done the calculations that Australian manufacturing – at least in terms of wool – can now compete on labour costs with China.

“I reckon we can actually process a kilo of wool cheaper than they can in China,” he said.

“If we bring 278 full-time jobs to this region and they bring families, that’s an extra 1000 people on an average family size and that means more employment in the town and more services.

“This region was thriving when we had the capacity to process our own wool. I want to see it return and there’s no reason why it can’t happen.”

Except the capital investment. Martin says he’s not interested in government funding and is currently starting talks with major investors keen to hear more about the project’s benefits.

Martin says the current diplomatic scrap between China and Australia couldn’t have come at a better time in terms of illustrating the risks associated with sending the bulk of your business to one customer.

He said the scale of the project would put the facility in the box seat to provide Australian woolgrowers with some local buffer against international shocks such as pandemics and trade tensions that have disrupted overseas processing for some of 2020.

China, which has already taken aim at other agricultural commodities this year such as beef, barley, seafood and wine, is certainly on the radar of Australia’s wool producers, and with good reason.

The country accounts for about 90 per cent of Australia’s greasy wool exports, leaving our shores and then processed for use in China’s textile and clothing market or sent across the world to the high-end fashion houses of Europe and North America.

The remaining 10 per cent of Australia’s greasy wool exports are shared between 10 other countries such as India, Italy, New Zealand, Thailand and the US.

Stuart McCullough, the CEO of AWI, the body in charge of marketing Australian wool, acknowledged at the organisation’s recent AGM that new markets were being actively pursued, but fell short of speculating on whether this was a contingency plan in case of adverse action from China.

“China is Australian wool’s biggest customer for many reasons including the size of its population, climate and growing affluence,” he said.

“They are a unique partner from a manufacturing point of view, but also from a consumption point of view as they are now consuming half of the Australian wool clip they buy domestically.

“In terms of major economies to recover from the disruption due to COVID-19 China is the clubhouse leader, by a long way. We are making the most of that with our current marketing campaign which is creating demand for wool and importantly leading to extra sales.

“AWI has also pursued an Emerging Markets strategy for eight years. That has seen an increase in processing and consumption of wool in places including India, Vietnam, Bangladesh and Sri Lanka.”