Reef credit scheme benefits untested, says Canegrowers

A scheme that Queensland taxpayers will fund to the tune of $10 million is aiming to put a price on improvements to water quality on the Great Barrier Reef, even though there’s concern farmers may lose production and returns while chasing improvement targets.

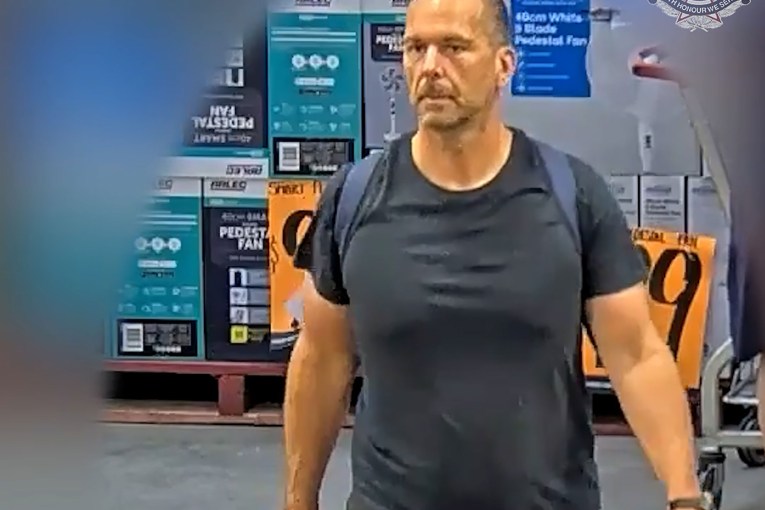

Tully cane grower Jamie Dore, who is the first recipient of Green Collar's reef credits, purchased by HSBC Bank, for environmental efforts on his property to improve water quality in the Great Barrier Reef. (Photo: Supplied).

Australia’s peak organisation representing sugar cane farmers remains wary of the reef credit system, which was launched last week by Queensland Premier Annastacia Palaszczuk at Fitzroy Island.

Similar to the carbon offset market which offers incentives for the reduction of carbon dioxide from the atmosphere, the scheme pays landholders for improved water quality resulting from their on-farm actions.

The gap between achieving environmental outcomes, which are still not properly quantified and remain contentious, and maintaining farm production and profitably, while not increasing compliance and input costs, is what has Canegrowers worried.

“Reef credits could hold potential for growers to supplement their incomes but the industry is yet to fully understand the potential trade-offs between production losses from some changes to farm practices and the income the credits generate,” a spokesman said.

Like grass, sugar cane does well with plenty of sunlight, water and nitrogen, which comes best from fertiliser.

Canegrowers is worried that if fertiliser rates are encouraged to be dropped below industry best-practice standards, then yields and returns will suffer.

“Work to assess these trade-offs is urgently needed,” the spokesman said.

“It will ultimately be up to growers to determine if reef credits are appropriate for them when all of the information is available.”

Canegrowers’ caution is at odds with the enthusiasm Tully cane grower James Dore has brought to the scheme.

A fourth-generation farmer and land developer, Dore is fully backing the scheme for his colleagues in the Tully River Catchment south of Cairns, the first region in Queensland where reef credits have been established.

“Reef credits recognise the value of the work undertaken by Queensland farmers and provide a valuable additional source of co-investment that isn’t impacted by commodity prices and doesn’t compromise existing agricultural practices,” he said.

The funds paid to farmers will come from the private and public sector, with HSBC Australia and the Queensland Government today announcing they are the first-ever private and public sector buyers of reef credits.

A statement issued on behalf of the partnership said:

“The first water quality market of its kind in the world, reef credits will play a pivotal role in protecting the future of the Great Barrier Reef as both an Australian and international icon.”

The Reef Credit Scheme was developed by GreenCollar, described as Australia’s leading environmental market developer and investor.

The statement says the scheme was developed in partnership with landholders, the Queensland Government and natural resource management organisations.

While Canegrowers had advance notice of the scheme, it is understood that AgForce, which also represent a small pocket of cane growers in the Burdekin, as well as beef producers on the Queensland coast, were not looped in on the preliminary discussions.

AgForce has been contacted for comment.

The launch of the scheme comes less than a fortnight after a federal senate inquiry into the science governing the Palaszczuk Government’s reef regulations ended in ambiguity, unable to unequivocally resolve the key question if conflicting scientific conclusions were leading regulators astray and damaging agriculture with no discernible positive impact on reef health.

As reported by InQueensland previously, the inquiry was instigated by the politically conservative Green Shirts Movement, loosely affiliated with AgForce and a long-time critic of Labor’s environmental laws, especially vegetation management, land clearing and reef regulations.

Their cause was taken up by federal Coalition Senators, including Queenslanders Susan McDonald, whose family has massive beef holdings in north-west Queensland and owns the Super Butcher retail chain and Central Queensland’s Matt Canavan, a fierce supporter of the coal industry.

Environment and Great Barrier Reef Minister Leeanne Enoch said the inquiry was “a political inquiry from the beginning and I’m happy to see that the committee has backed the scientific evidence and Queensland’s reef regulations”.

“Report after report has demonstrated that poor water quality is affecting the health of the Great Barrier Reef and I extend my thanks to the experts who participated in the committee process and stood up for science, at great personal cost, given the appalling way they were treated and attacked by LNP members of the committee,” she told InQueensland earlier this month.

In a statement issued in conjunction with the reef credit scheme launch, Enoch said:

“The establishment of the Reef Credits Scheme, this first purchase, and a new partnership between GreenCollar and HSBC signals the start of an exciting new way to value natural capital and actions taken to deliver good environmental outcomes.”

Reef credits explained

For InQueensland readers keen to know more about reef credits, the information below is taken from the media pack issued by GreenCollar.

Reef credits provide a measurable, audited water quality outcome tracked against internationally recognised targets and based on actual reduction in pollutants entering the reef.

GreenCollar estimates that the market could be worth over 6 Million Reef Credits by 2030, opening the door for more businesses to invest in the future of the reef as part of their environmental, social and governance (ESG) strategies.

For farmers and graziers, Reef Credits provide an opportunity to recognise, value and monetise the critical actions they undertake to provide cleaner water to the Great Barrier Reef.

GreenCollar builds long term partnerships with landholders to improve the productivity of their land and generate an additional, diversified income stream. Through this, landholders are able to integrate sustainable practices into their existing operations.

The announcement forms part of HSBC’s newly announced climate ambition statement that aims to accelerate the transition to net-zero carbon through finance, and will scale nature-based solutions between now and 2025.

Kaber Mclean, CEO, HSBC Australia, said:

“Partnerships like this between governments, the private sector and firms like GreenCollar are vital to achieving net zero carbon, and appropriately valuing and investing in natural capital.

“Our participation in this global first reinforces our credentials as a sustainable finance pioneer in the Australian market, as well as our commitment to safeguarding natural assets like the Great Barrier Reef.”

James Schultz, GreenCollar co-founder and CEO, said:

“We are thrilled to work with farmers and like-minded partners in HSBC and the Queensland Government to issue the first Reef Credits, endorsing the scheme as a viable market-based solution to put the environment on the balance sheet of responsible corporations.

“The investment required to meet water quality targets for the Great Barrier Reef is estimated at $4 billion, and this announcement provides an exciting opportunity for corporations, landholders and government alike to make their own contributions to this target.”

“The Great Barrier Reef contributes $6.4 billon to the national economy and supports more than 64,000 jobs up and down the Queensland coast.

“Poor water quality is the second-biggest threat to the reef, and helping to protect this iconic asset will continue to support these jobs and businesses.

“It is exciting to see both leaders in the private and public sectors investing in the work we’re doing, and supporting the future of this iconic asset.”