Hunger Games: How the pandemic is fuelling fears of a food security crisis

Threats to our food supply chain existed long before COVID-19. But the pandemic is unearthing previously buried fault lines in the system that have authorities and experts on alert, writes Brad Cooper

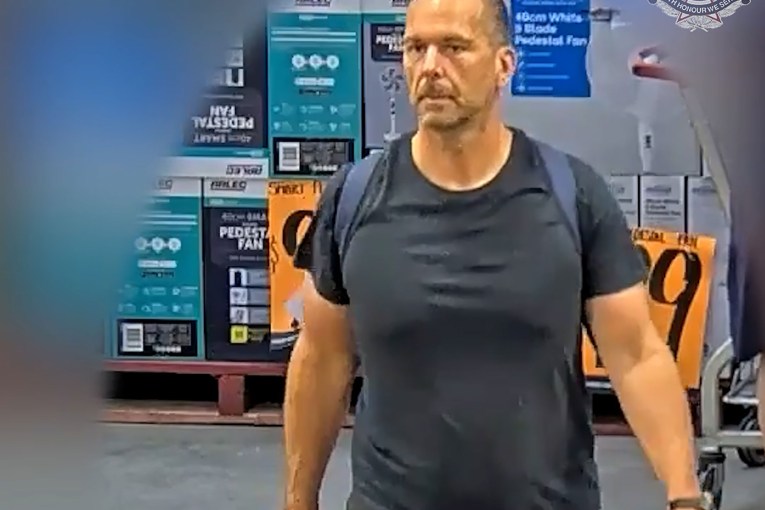

Grain Growers chairman Brett Hosking has confidence in Australian wheat stocks. Photo: Supplied.

Could Australia run out of food?

We should be alert, but not alarmed, says Associate Professor Robin Roberts, who leads an agribusiness and trade program within the Griffith Asia Institute, part of Griffith University’s Business School.

The straight-talking academic is confident the country’s long and complex food supply chain will be robust enough to withstand any COVID-19 induced stress – but there will be shocks along the way.

As she explains, food supply chains have five points of susceptibility: production (our ability to grow food), logistics (our ability to deliver food where and when it’s needed), processing (turning food into a saleable product), resource availability and well organised retail and food-service channels to market.

“There was always the chance we were going to have a food security problem before COVID,” Roberts said.

“Anyone of those interplaying factors is always at risk – just take nature as an example and what that means for agricultural production.

“Just because COVID is taking the headlines doesn’t mean climate change has stopped.”

Roberts believes the Australian buying public can feel reassured by their food suppliers because the industry remains at a heightened state of preparedness, is at the forefront of engagement with digital technology and state governments are making decisions about what remains in their respective jurisdiction’s best interests via the new national cabinet arrangement.

Despite her words of reassurance, signs of a food system under strain from COVID-19 are hard to shake.

Already COVID-19 outbreaks have caused temporary closures to retail outlets, meat processing plants and supermarket distribution centres.

Travel restrictions and border closures have made it tough to recruit farm labour to help with harvest, while fewer planes in the air have caused airfreight availability to tighten.

Even a trade skirmish between Australia and its largest trading partner, China, can be sheeted home – although not officially – to coronavirus tensions, febrile conditions that have hit barley growers and four beef processing plants expected to cost the Queensland economy $581 million.

Has there ever been a time when such negative attention has been focused on Australia’s food supply chain? Little wonder Australian shoppers are prone to fits of panic buying, stripping the shelves of pasta, rice and red meat.

Grain growers on task

Grain Growers chairman Brett Hosking says Australian wheat farmers are staring at a bumper crop this season, which will fill depleted stocks once harvest starts in Queensland from September and moves south towards the end of the year.

“One of the difficulties we have is that we never know with 100 per cent accuracy just how much grain we have in storage at any one time,” Hosking said.

“What we do know is that we have bulk exports of wheat and barley going overseas, so if the exporters are exporting, we can be sure we’re not at some tipping point at the moment, because the Australian domestic market is the bast paying market in the world and that’s where any grower would want to be selling any day of the week.”

Hosking’s assessment reinforces the message from federal Agriculture Minister David Littleproud and National Farmers Federation president Fiona Simson that Australia’s food supplies are safe, with the nation’s farmers producing enough food every year to feed 75 million people – almost three times the current Australian population.

Queensland Farmers Federation CEO Dr Georgina Davis concedes the COVID-19 pandemic is causing uncertainties in global food supply chains, with potential bottlenecks in labour markets, input industries, agriculture production, food processing, transport and logistics, as well as shifts in demand for food and food services.

“However, consumers can rest assured that Australia does not have a food security problem, in fact we’re one of the most food secure countries in the world,” Davis says.

“According to a recent ABARES report, Australian farmers are among the world’s best at growing quality food and fibre, even in difficult years where drought and other natural disasters have impacted production, we export around 70 per cent of our agricultural production.

“While food imports only account for around 11 per cent, allowing access to manufactured food and beverages, different varieties of some items, and out of season fresh produce.”

Davis says Australians spend just 9.8 per cent of their household income on food each year, one of only eight countries in the world to spend less than 10 per cent.

“Additionally, the country ranks twelfth on the Global Food Security Index, with the agricultural sector continually providing affordable, accessible, high quality, fresh and safe food,” she says.

“And despite an expanding global population, the joint OECD and UN Food and Agriculture Organisation Agricultural Outlook 2020-2029 found that over the next ten years, supply growth is going to outpace demand growth.”

Figures under fire

Calculations that politicians and farm leaders are using to reassure worried minds came into question earlier this month from grain speculator Chris Brooks who tipped Australia would run out of grain by September.

The farmer-activist told news website Crikey that Australia’s east coast-concentrated flour millers would be short of the raw material that goes into making pasta, bread and other wheat-based staples in supermarkets.

The former chief of Australian operations at mining company Glencore explained that in a world gripped by the COVID-19 pandemic, there were no guarantees foreign-sourced wheat would be available if local stocks ran low, just as they did in the second half of last year on the back of drought when Canadian imports arrived to fill the east coast shortfall.

Brooks also shares concerns for rice, dairy and pork. They are intensive industries, and, especially in the case of the latter two, seriously eroded over years of either low farm gate returns and cheap foreign imports that have driven local producers from the industry.

Brooks said the Government and NFF line doesn’t stack up because the “75 million people” calculation also includes inedible products: “wool, wine and woodchips” in the agricultural category.

The figures quoted by Littleproud, Simson and Davis are also based on an Australian Bureau of Agricultural and Resource Economics and Sciences’ (ABARES) “Analysis of Australian food security and the COVID-19 pandemic” report, which took production over a three-year average, including the past two years of drought, but also 2016 which was a stellar year for agricultural production.

Wheat production, for example, increased by 42.85 per cent from 2015.

Another strident critic of NFF and government assumptions is a former RAAF deputy chief now strategic policy consultant, John Blackburn.

As he explained to Crikey journalist Kurt Johnson, his concern is national security and he’s analysed food supply from the perspective of national vulnerabilities.

“It sounds good to say we can feed 75 million people … ,” he says. “Are they factually incorrect about those particular figures? No. Are they distorting the picture for a political purpose? Most likely. Because they have not done the analysis.”

As Johnson further summarises Blackburn’s position:

There is more to getting food to shelves than simply producing a glut of raw ingredients.

Our food manufacturing and distribution networks rely on packaging materials, fuel, fertilisers, refrigerated containers and labour to ensure food reaches its destination unspoilt.

After the pandemic, distribution and the labour required for processing will return to normal.

Yet much of the food on shelves arrives as the product of an extended supply chain, heavily reliant on imports vulnerable to disrupted international shipping, trade spats and measures to contain the pandemic.

National self-reliance on our food-producing capability and the inputs required to get food out of the ground and onto supermarket shelves is at the core of the issue that has authorities worried.

As Johnson further cites: diesel, for example, is 83 per cent imported – a cause for concern indicated by a recent federal government decision to double Australia’s emergency fuel reserves without directly acknowledging the move was linked to food supply chain resilience.

Farming “full steam ahead”

Specialist agribusiness bank Rabobank reports that at least one key input for growing crops – fertiliser – is going into the ground “full steam ahead”, helping growers take advantage of favourable rainfall across a lot of the wheatbelt in recent months.

Rabobank’s latest semi-annual Global Fertiliser Outlook says global fertiliser prices are either at, or near, 10-year- lows, with the plummeting cost of raw materials, growing production capacity and mediocre demand keeping prices of nitrogen (urea), as well as phosphate and potash down.

Report co-author, Rabobank agricultural analyst Wes Lefroy says one of the key factors driving down prices is the falling cost of energy.

“The abrupt drop in fuel demand during COVID-19 lock-downs forced the price of natural gas down 46 per cent (UK NG ICE) and coal 11 per cent (ZCE Thermal Coal) – both critical to the production of urea and processed phosphate,” he says.

The report agrees with other forecasters that the Australian winter-crop planted area will increase by 26 per cent this year, up 12 per cent above the five-year average, boosting urea demand.

With La Nina conditions a possibility this spring, Lefroy says, urea application will continue in earnest.

Domestically, that means local farmers are taking full advantage of reduced input costs – however the recently-released Global Fertiliser Outlook warns that COVID-19 has amplified the risk of isolated shortages and resulting price increases.

Respected grain analyst Lloyd George says, like Hosking and other industry colleagues, he’s not picking up any signals the grain market is under stress.

“If buyers were concerned that they were running out of grain the market would reflect that,” he says.

“It’s like when shoppers fear food is running out, they fall over themselves in a panic to buy what they can.

“We’re seeing nothing like that in the grain market at the moment.”

George says that while grain stocks are tight in SA and WA, flour millers will have their stocks firmly locked away to fulfil longstanding orders to buyers of the best milling material.

Demand for lower quality grain to feed cattle has also fallen away due to more grass in paddocks from recent rain.

He says Australia is on track for at least a 25 million tonne crop, possibly even as high as 27 million tonnes if the finish is good, with our two biggest grain-producing states – NSW and WA – tracking positively towards that end.

For Grain Growers boss Brett Hosking – at his farm near Swan Hill in Victoria where COVID is ravaging the state – if there’s any upside to the pandemic it’s the focus now being applied to the business of farming and the mechanisms that deliver food across myriad networks across the country.

He says Australia is the leading producer of grain per capita – about one tonne of wheat for every man, woman and child each year. He says it’s a reputation Australian farmers are not going to relinquish, despite what COVID-19 might bring next.

“I love my porridge for breakfast and bread for my hamburgers and my malting barley and we’ll be making sure that this is always available for shoppers on the shelves,” he says.

“Because I certainly don’t want to go without either.”