No other way: Time for new and higher taxes, says former competition chief

Former competition tsar Rod Sims has called for higher taxes on fossil fuels, carbon, minerals and land to fund the services Australians want.

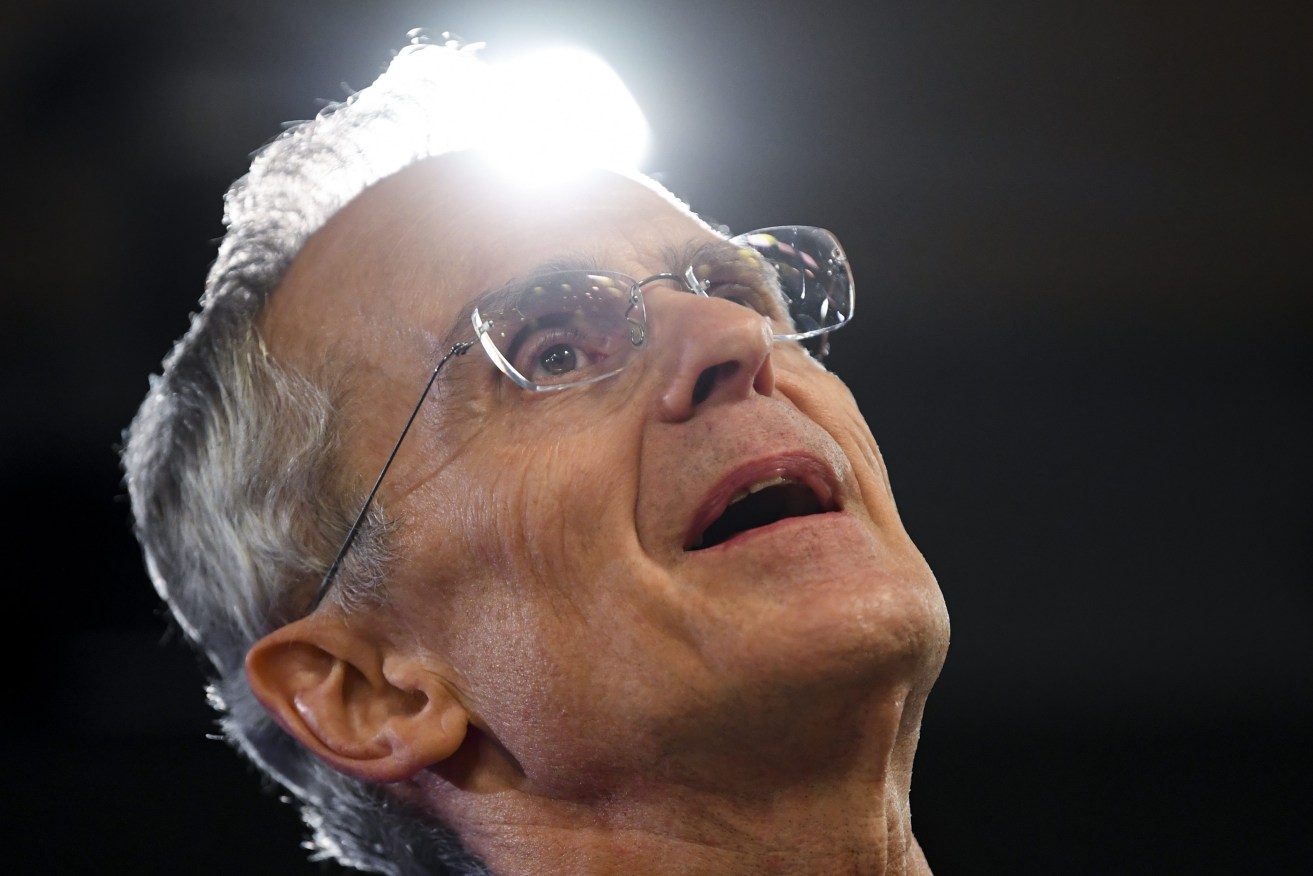

Former Australian Competition and Consumer Commission chair Rod Sims said gas costs could be lowered (AAP Image/Lukas Coch)

The renowned economist and former Australian Competition and Consumer Commission chair said the only way to boost the budget’s bottom line and underpin higher spending was through taxation.

“We have a lot of tax spaces out there and we need to have a discussion about what expenditure levels we want,” he told ABC TV.

“If we want higher expenditure, we can only do it through higher taxation. There’s no other way.”

Sims said Australia needed to look at a carbon tax if it was serious about transitioning to a net-zero economy, noting 70 per cent of revenue already came from income and company taxes.

He said offering incentives to boost the take-up of renewable and low-emissions technologies like electric vehicles would only benefit wealthy Australians who were able to afford them.

“How we expect to achieve our climate change objectives without changing relative prices where carbon intensive activity pays more … I just don’t know,” he said.

But the former ACCC chair declined to weigh in on the debate about stage-three income tax cuts, saying three weeks before Labor’s first budget may be too premature to consider new taxes.

“There is a fair way to go in that discussion that we probably won’t get to by the October 25 budget, but hopefully the budgets after that,” he said.

There has been speculation the government is considering changes to the legislated stage-three tax cuts, which will largely benefit high-income earners, although government ministers have consistently stood by the plan.

Labor Party president and former federal treasurer Wayne Swan said the government would be naive to not consider international factors ahead of the upcoming budget when weighing tax changes.

He told Nine’s Today program the government had not broken an election promise to keep the stage-three tax cuts, scheduled to be introduced in 2024-25, as no decision had been made.

“But any government that sat down in this environment and said they weren’t going to review all of the policy settings in light of what has gone on, would be sticking its head in the sand,” he said.

Finance Minister Katy Gallagher on Wednesday said the government hadn’t shifted its policy but did not deny that a shift was being discussed.

Former Reserve Bank of Australia governor Bernie Fraser said he was surprised Labor committed to the stage three tax cuts and ensconced them in legislation.

“There is no honour in the government standing by what is really a very dodgy commitment and hardly an unbreakable one,” Fraser said.

He urged the government to repeal the stage three tax cuts and consider other ways to boost tax revenue to help fund its reform agenda.

However, the federal opposition said any changes to legislated tax cuts would hurt Australians facing interest rate hikes and would constitute Labor breaking its election promises.

Deputy Liberal Leader Sussan Ley said Australians needed tax relief now more than ever with interest rates spiking.

Reading out Labor media releases and comments from now-Prime Minister Anthony Albanese pledging support for the tax cuts as legislated before the election, Ms Ley said changes would be a “fundamental breach of faith”.

“This is a tax cut millions of Australians were promised, millions of Australians are expecting and millions of Australians are owed,” she told reporters in Sydney.