Financial literacy plan makes perfect cents for First Nations people

A shameful history of being paid in rations, cheated of wages and paid extremely low income has left many Indigenous Australians with low levels of financial literacy, which a team of financial educators is trying to turn around.

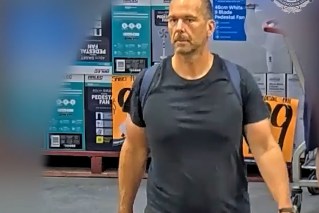

First Nations Foundation chairman Ian Hamm. (Photo: Supplied).

By her own admission, Tatum Moore never had a firm understanding of her own financial situation.

“I would keep track of my income and what I needed to pay for bills, but I never really took the time to work out how much I could save each week,” she says.

“I grew up with a single mum, living in social housing and the only income was Centrelink. We lived in a ‘scarcity mind-set’.”

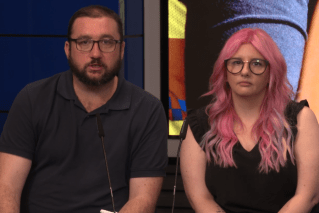

The CEO of Dubbo’s local Aboriginal Land Council in central west NSW, is one of more than 1500 Indigenous Australians who last year completed financial literacy courses with Australia’s only national Indigenous financial literacy organisation, First Nations Foundation (FNF).

Founded in 2006, the organisation this month released its most detailed report yet into the program at Suncorp Bank’s head office in Brisbane, measuring the progress made towards their mission of sharing a wealth of Indigenous-led financial knowledge, and empowering the Indigenous community through education to help achieve financial independence.

According to FNF chairman and Yorta Yorta man Ian Hamm, from near the Albury-Wodonga region on the NSW-Victorian border, First Nations communities have had very little opportunity to manage their own money.

Speaking at the Brisbane launch, he said that while there were more Indigenous people gainfully employed than ever before, and with that accruing decent salaries, most Indigenous people still did not have access to a trusted source of information, or were too ashamed to ask for help within the services sector.

“This diminishes the opportunity to create intergenerational wealth and is at the core of why FNF exists,” he said.

“It proves that programmes designed by Indigenous community organisations, based around the articulated needs of ordinary Indigenous people, have the greatest impact and the best sustainable long-term effects.

“With the assistance of our funding partners, we have been able to curate a programme that delivers positive intergenerational change, educating participants in areas of financial well-being, developing better money management skills and habits as well as building financial prosperity.”

Moore said the course had made her feel more positive towards money.

“I believe money gives us choices and opportunities,” she said.

“I believe it is merely a token to be exchanged for something we want and/or need. My mindset today is a lot more positive.”

Stories like those expressed by Moore have inspired FNF CEO Phil Usher to continue exploring ways to further educate all First Nations communities.

“The stories show the enormous impact that we can have on an individual in a short period of time… our research shows our participants will share their knowledge with up to six family and community members meaning we have even greater impact,” he said.

“Culture is at the heart of everything we do, so it’s truly gratifying seeing our efforts recognised through these responses. Understanding the Indigenous perception of money and family responsibilities can only be gained through lived experiences. All our training and content is written and delivered by Mob, for Mob.”