Prime cut: China’s trade beef to cost us $581 million, report warns

China’s suspension of imports from four Australian abattoirs in May could cost the beef industry $581 million as momentum to seek new trading partners gathers pace.

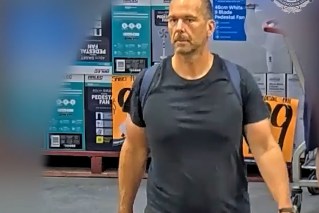

Not even the COVID-19 pandemic is expected to stifle buyer confidence in a what experts are tipping will be a bull market for cattle sales in Queensland. (Photo: ABC)

The calculation from Adept Economics is based on volumes that were sent overseas last year when China accounted for 24 per cent of Australia’s total beef and veal exports.

The plant suspensions hit three abattoirs in Queensland and one in northern NSW, responsible for exporting 35 per cent of beef exports to China in 2019.

If other abattoirs are unable to ramp up production to meet Chinese demand, the industry will suffer a $581 million revenue shortfall, with the brunt of the impact felt in Queensland, the report said.

The beef plant suspensions were part of wider actions taken by China to restrict agricultural trade, with barley another commodity targeted in what some have viewed as an escalating trade war.

“Of agricultural goods exports last year, beef was the largest earner with barley finishing in 12th place,” the report said.

“As such, the cost of these trade restrictions could be quite severe, especially given the current economic climate.”

China has increased its consumption of Australian beef 60-fold over the past decade, with the steepest spike in demand experienced in 2019, driven by African swine fever’s devastation of domestic animal protein supply in China.

The action against Australia has forced China to look elsewhere, lifting a 19-year import ban on US beef in February and turning to Russia, from which they sourced 21.4 tonnes on May 3.

As InQueensland has previously reported, Australia exports beef to more than 100 destinations, with no one single export market taking more than 25 per cent of the country’s total output.

The Adept Economics report acknowledges the widespread of markets “will come in handy for the current trade dispute”.

Life after China

The latest modelling on lost agricultural income from China trade tensions comes as Australia signs a new economic partnership with Indonesia and trade experts forecast a possible future where China is no longer Australia’s number one trading partner.

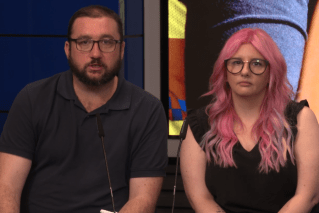

Associate Professor Fengshi Wu, an expert in Chinese state-society relations at the University of NSW, said China’s rise as a global power was not “set in stone”, and that exploring options for trade elsewhere was something Australia should consider seriously.

“Since the onset of COVID-19, the American Government has made a considered effort to dissuade US companies from maintaining a presence in China,” she said.

“Governments [including Australia] could play a role in making their own transnational business relations weaker in order to reduce economic interdependence.

“After a decade there could be an accumulative impact, then China may no longer be the number one trading partner for Australia.

“It’s possible to change that economic and trade dependence on China. It’s not fixed.”

Indonesia’s new lifeline

Long touted as one of Australia’s most attractive export prospects, given its close proximity, large population and rising affluence, Indonesia moved a step closer this week to improve on its position as our sixth-largest trading partner with the signing of the Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA).

In announcing the agreement – which will see almost all Australian goods enter Indonesia either duty-free or under significantly improved arrangements – Agriculture Minister David Littleproud delivered a message for his domestic stakeholders and Chinese officials who have sought to damage the Australian economy with trade strikes.

“By 2050 Indonesia is projected to be the world’s fourth-largest economy, with per-person consumption predicted to be greater than China for key commodities such as cereals and beef,” Littleproud said.

“With many restrictive tariff requirements for our exporters being eliminated under this agreement, Indonesia represents a game-changing opportunity for our farmers.

“Securing this breakthrough with our sixth-largest agricultural export market will help turbocharge trade opportunities in both countries and propel our post-pandemic recovery.”

Littleproud said more dollars would flow into the hip pockets of our beef, cattle, grains and horticultural producers, and into their rural and regional economies on the back of the agreement.

“The benefits will be across the board and are a reminder of how our farmers and the agriculture sector will continue to be the bedrock of our recovery from the COVID-19 crisis,” he said.

Highlights from the agreement include:

- A quota of 575,000 live Australian male cattle per year will enter Indonesia duty free. The quota will increase to 700,000 per year by 2026. Previously, live male cattle had a five per cent tariff.

- There will be a 2.5pc tariff cut for frozen beef, which previously had a five per cent tariff. After five years the 2.5pc tariff will be eliminated.

- Australian exporters of feed grains such as wheat, barley and sorghum will enjoy duty free access for up to 500,000 tonnes per year into Indonesia. The quota will increase by five per cent per year.

- Horticulture exporters will also benefit, with reduced tariffs and improved access across a range of commodities including citrus, carrots and potatoes.

“Our dairy farmers will benefit from the elimination of a five per cent tariff on concentrated and sweetened milk and cream,” Littleproud said.

“There will also be the elimination of a five per cent tariff for grated and powdered cheese of all kinds.”

Industry reaction has been positive, with Queensland farm group AgForce tweeting:

“Trade opportunities like these allow businesses to manage volatility by spreading risk across markets.”