Has inflation turned the corner? Interest rate pain begins to fade

The Reserve Bank board will meet next week with the news that inflation plunged to 4.9 per cent for the year to the end of October.

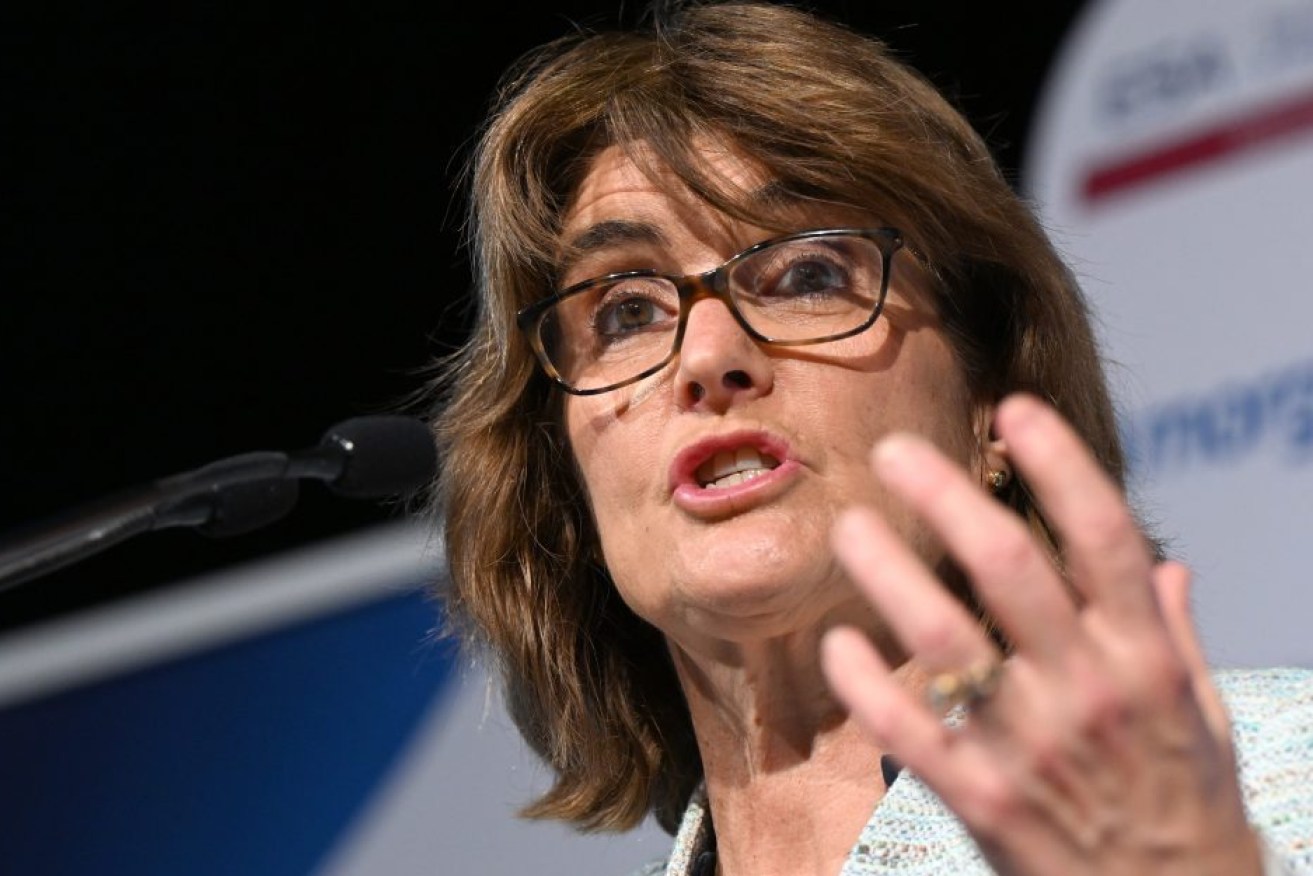

The Governor of the Reserve Bank of Australia, Michele Bullock addresses the Economic Society of Australia in Brisbane. (AAP Image/Darren England)

The fall was much stronger than anticipated by the market which had been expecting the rate to drop from 5.6 per cent to 5.3 per cent, but business had also been reporting severe impacts from the RBA’s series of interest rate rises.

The rate is now in steep decline from its peak of 8.4 per cent in December last year and economists believed it lessened the risk of another rate hike next week.

AMP Capital economist Shane Oliver said if the monthly CPI averaged 0.3 per cent for November and December (which is the average of the last three mths), then year on year inflation would fall to 3 per cent by December which is the top end of the target for the RBA.

It would be helped along by the fact that the big rises .9 per cent 1.5 per cent in November and December last year drop out of the yearly average.

“It’s never that simple but Australian inflation is likely to fall sharply,” he said.

The fall in the latest figures was mainly due to weakness in vegetables, rents (which were impacted by rent assistance), auto fuel and travel.

He said it should head off a December rate hike, but the high underlying inflation would mean the RBA would retain its “hawkish” stance.

He said new dwelling inflation was still high, but well down from last year. Rent inflation slowed but without changes to rent assistance it would be 8.3 per cent.

Electricity prices were up 10.1 per cent on the same time last year.

The Australian dollar dipped on the news while the ASX200 jumped. The dollar then reversed as Chinese yuan resumed its rally aginst the US dollar.

During the day, the likelihood of another rate hike in December fell from 72 per cent to 48 per cent.

Construction activity expanded by 1.3% in the Sep quarter, well above estimates. Engineering (2.6%) the main driver, with broadly offsetting contributions coming from residential (1.3%) and non-residential (-1.6%) work.

The fall follows comments from RBA Governor Michele Bullock that she had been surprised by how households were holding up after 13 interest rate increases since May last year.

But she also warned it was “very uncertain” inflation will return to target of between 2 and 3 per cent in the next two years.

The Australia Bureau of Statistics’ Leigh Merrington, acting ABS head of prices statistics, said the most significant contributors to the October annual increase were housing (+6.1 per cent), food and non-alcoholic beverages (+5.3 per cent) and transport (+5.9 per cent).

When volatile items were excluded the annual rise in October is 5.1 per cent, lower than the annual rise of 5.5 per cent in September.

The increase in housing costs of 6.1 per cent was also lower than the 7.2 per cent increase in September. New dwelling prices rose 4.7 per cent, which is the lowest annual rise since August 2021, as building material price increases continued to ease reflecting improved supply conditions.

Rent prices rose 6.6 per cent in the 12 months to October, due to low vacancy rates and a tight rental market.

“The annual increase in rents is lower than the rise of 7.6 per cent in September largely due to the increase in Commonwealth Rent Assistance that took effect from 20 September 2023 and reduces rents for eligible tenants. Excluding the changes to rent assistance, Rents would have increased 8.3 per cent in the 12 months to October,” Merrington said.

The ANZ Bank said it retained its view that the RBA would remain on hold in December.

Mozo spokeswoman Rachel Wastell said the quarterly CPI was more reliable than the monthly.

“Despite the drop in many items in the CPI basket, the stickiness of services inflation is still quite evident, particularly when looking at the double-digit inflation figures for energy, which despite a decline are still sitting at 13 per cent for Gas and other household fuels, and 10.1 per cent for electricity.”

“Also, the fact that the insurance and financial services inflation figure of 8.6 per cent has not dropped since September shows that although inflation is declining, prices for services are still high.

“It’s probably enough to convince Bullock that another rate rise in December isn’t necessary, but if there is an uptick to inflation in the quarterly CPI at the end of January, it could be enough to convince the new Governor that another hike is needed in February.”