House prices rise again; mortgage stress now double since rate hikes first began

A record number of Australians were now at risk of mortgage stress and house prices around Australia were continuing to climb.

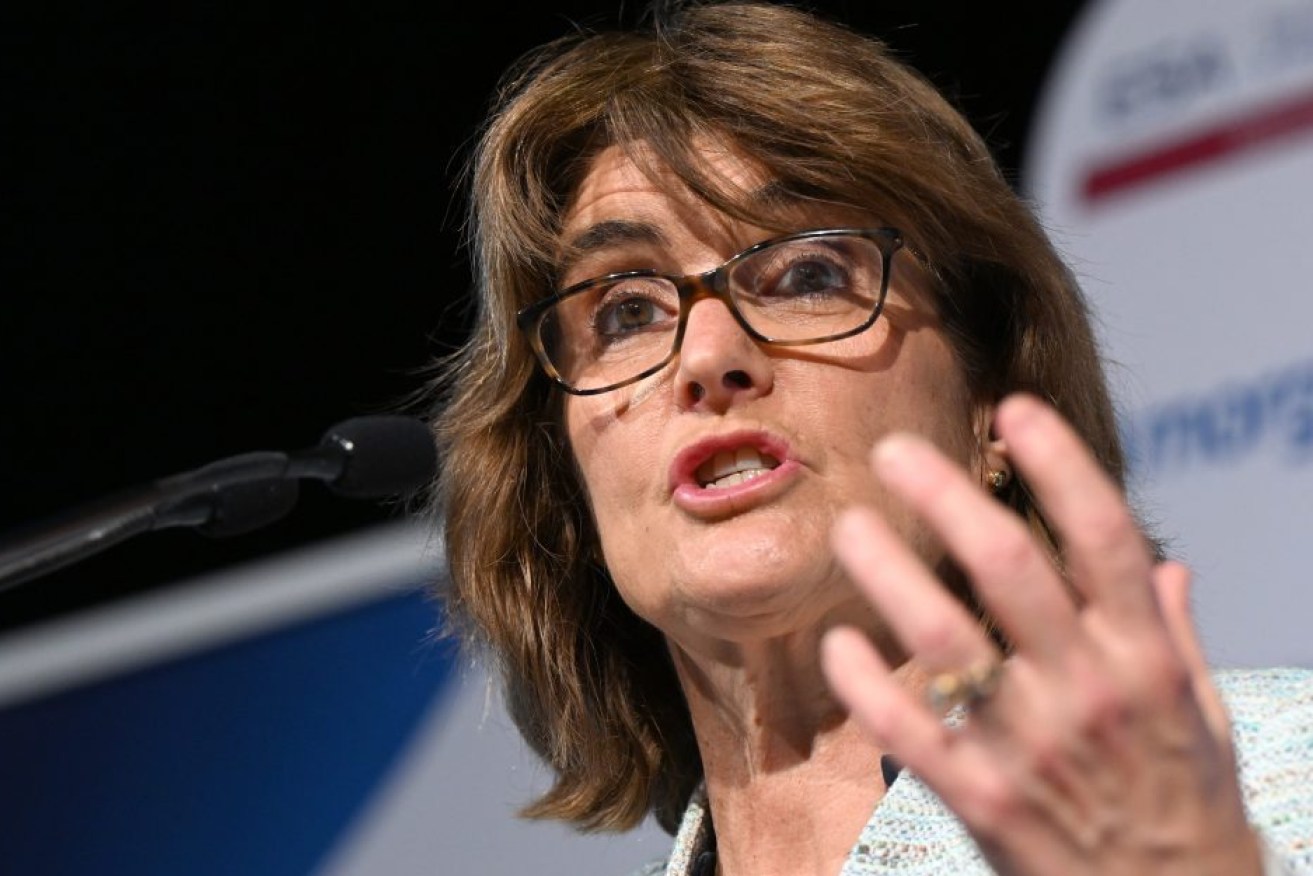

The Governor of the Reserve Bank of Australia, Michele Bullock addresses the Economic Society of Australia in Brisbane. (AAP Image/Darren England)

As the Reserve Bank board meets today, Roy Morgan revealed 1.57 million Australians were on the verge of mortgage stress and this was likely to climb to 1.65 million if the interest rates increase.

Since the RBA started lifting rates in May, 2022, the number of people in mortgage stress, as defined by Roy Morgan, had more than doubled from 759,000.

While many economists believe the RBA will continue to hold interest rates at the current level, ANZ said it expected the new RBA governor, Michele Bullock, would set a hawkish tone.

But Roy Morgan’s Michele Levine said higher petrol prices and energy costs were eating into household income.

‘Therefore, although many have suggested the RBA has finished its cycle of interest rate increases, the low Australian Dollar and high petrol and energy prices adding to inflation may force their hand for further interest rate increases in the months ahead,” Levine said.

“These possibilities are a key factor in why we have modelled two further interest rate increases. If the RBA does raise interest rates this week by 0.25 per cent, Roy Morgan forecasts mortgage stress is set to increase to over 1.65 million mortgage holders (31.4 per cent) considered “at risk’’.

“Of even more concern is the rise in mortgage holders considered “extremely at risk’’, now estimated at 1,066,000 in August 2023 – a new record high. This figure has more than doubled since the RBA began raising interest rates, representing an increase of over 580,000 mortgage holders.”

CoreLogic data for September showed Brisbane house prices rose 1.3 per cent. For the past 12 months they are up 5 per cent to a median value of $761,000.

Since hitting its bottom in January, the Brisbane market has risen 9 per cent.

Regional Queensland was up 5.9 per cent since its bottom and was up 3.6 per cent for the past 12 months.

“In contrast, the estimated volume of home sales across the combined capital cities was 1.9 per cent higher than a year ago and 6.3 per cent above the five-year average,” CoreLogic’s Tim Lawless said.