A new age for RBA as Michele Bullock becomes first woman to control nation’s coffers

Michele Bullock will be the next Governor of the Reserve Bank and the first woman to hold the post that has so much power over the economy and the fate of mortgage holders.

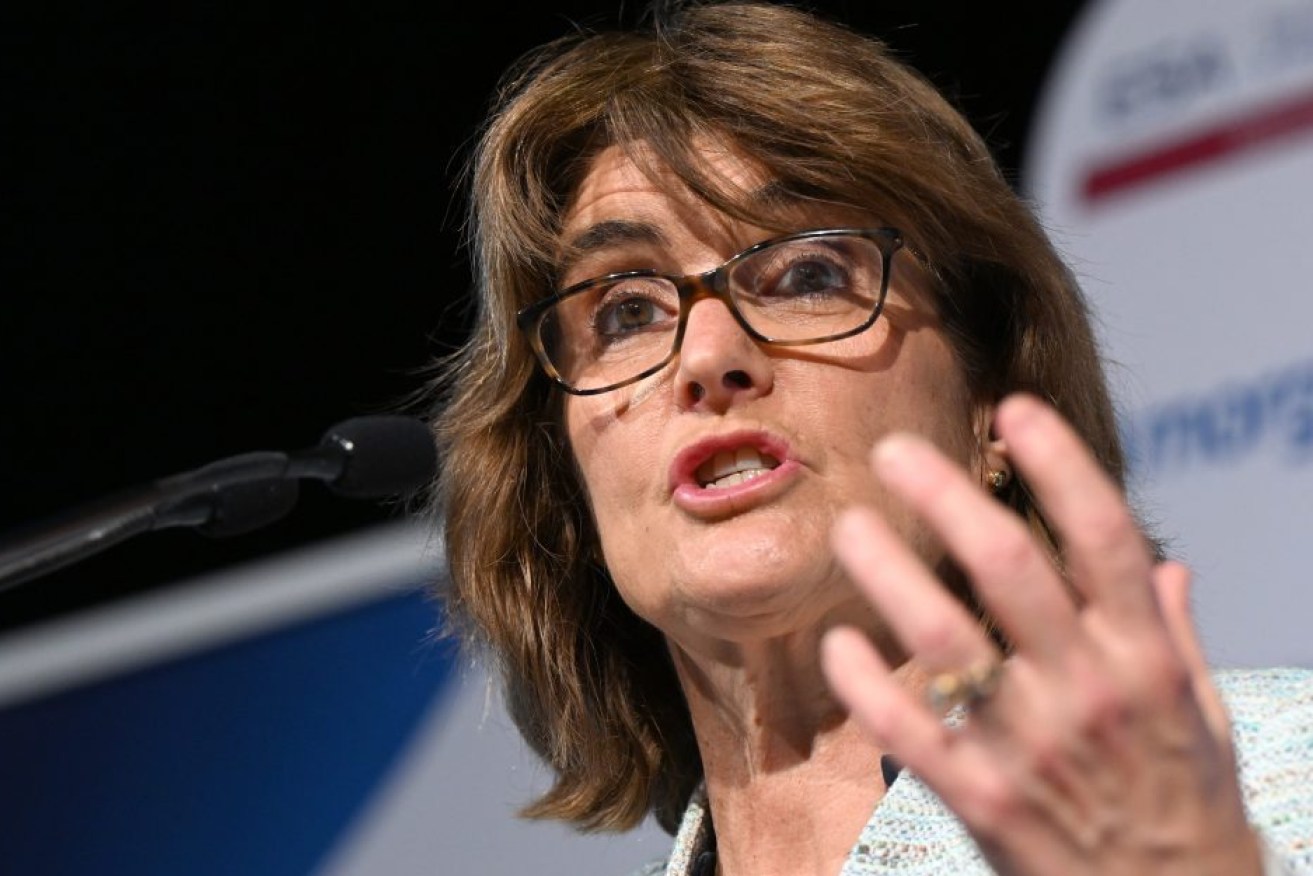

The Governor of the Reserve Bank of Australia, Michele Bullock addresses the Economic Society of Australia in Brisbane. (AAP Image/Darren England)

The decision, announced this morning, brings an end to the term of Philip Lowe and was likely to usher in major changes already flagged for the RBA.

Bullock, who is currently deputy governor of the RBA will begin her seven-year term on September 18.

Treasurer Jim Chalmers said Bullock’s appointment struck the optimal balance between providing exceptional experience and enterprise and offering a fresh leadership perspective.

Prime Minister Anthony Albanese congratulated Bullock.

“Michele is an outstanding economist, with a long and distinguished career at the central bank. At a critical time for the global economy, her job will be an important one,” the Prime Minister said.

Lowe admitted the appointment of Bullock was a good one.

“The Treasurer has made a first-rate appointment. I congratulate Michele on being appointed Governor,” he said.

“The Reserve Bank is in very good hands as it deals with the current inflation challenge and implementing the recommendations of the review of the RBA.”

Bullock said she was deeply honoured to be appointed to the role.

“It is a challenging time to be coming into this role, but I will be supported by a strong executive team and board,” she said.

“I am committed to ensuring that the Reserve Bank delivers on its policy and operational objectives for the benefit of the Australian people.”

IFM economist Alex Joiner said the appointment meant little in terms of policy direction.

“I suspect she will need to focus on implementing the review and importantly steady the #RBA ship with so much central banking experience being lost recently with Lowe, Debelle, Ellis, Kearns, Heath (at least on secondment) all gone,” he said.

Before the decision was made, the ANZ today changed its call on interest rates, saying the RBA was likely to leave rates unchanged at its next meeting.

“This change in our view is unrelated to any decision regarding the RBA Governor,” the bank said.

“Rather it reflects an assessment of the economy based on a deterioration in forward‑looking labour market indicators, good news on the global inflation front and increasing anecdotal evidence (including in our own spending data) that the most recent rate rises have had an impact on consumer behaviour.”

There had been speculation that the Government would look outside the ranks of RBA for a replacement, but Bullock’s appointment was likely to be an acceptable one to markets.

Chalmers also thanked Lowe for his service and said he had overseen the bank during a period of exceptional economic disruption and uncertainty.

“We respect and appreciate the remarkable dedication and contribution he has made to our country and our economy and the way he has conducted himself in a difficult role at a challenging time,” Chalmers said.