Lowe pressure: Reserve Bank chief feels heat as ex-boss Bernie blasts leadership

The Reserve Bank’s credibility has been damaged by flawed interest rate predictions while the central bank continues to provide “unhelpful” pointers to future increases, its former head says.

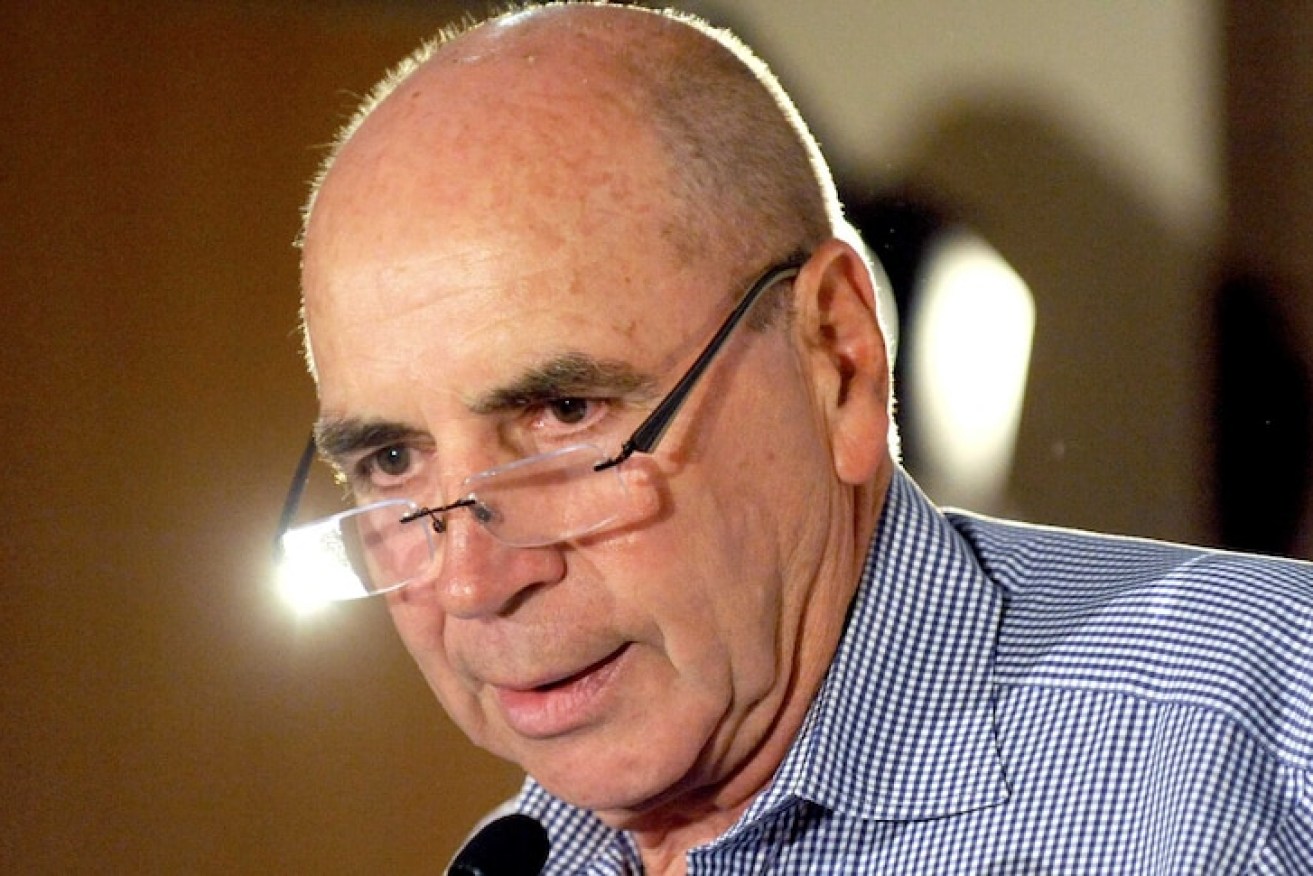

Bernie Fraser has delivered a stinging critique of the current Reserve Bank leadership.(AAP: Alan Porritt )

The scathing assessment from Bernie Fraser, who led the RBA for seven years before his tenure ended in 1996, comes as current governor Philip Lowe prepares to face a parliamentary grilling on Wednesday following a series of rate hikes.

Last week, the central bank lifted interest rates to 3.35 per cent, the ninth rise in the current cycle.

It has indicated that further rate rises will be needed to rein in spiralling inflation, which grew by 7.8 per cent annually in the December quarter.

But Mr Fraser said it would be better if the RBA flagged the possibility of further rises while watching for the impact of the existing interest rate hikes rather than giving strong predictions.

“The market has sort of jumped on and interpreted this as the likelihood or near-certainty of another three or four increases to interest rates,” he told ABC radio on Wednesday.

“And that’s unhelpful and doesn’t provide the kind of confidence that the bank should be striving to enlist with the community.”

Treasury secretary Steven Kennedy, who has a seat on the RBA board, said criticisms of interest rate decisions should be applied to all board members.

“The criticisms or otherwise of the interest rate decisions apply to the whole board, not just the governor, because it’s the board that makes the decisions,” he told a parliamentary committee on Wednesday.

Dr Kennedy said he would not speculate on the trajectory for future monetary policy decisions and the governor was responsible for providing communications on the matter.

The nine interest rate rises have been driving up home loan repayments, with the federal government concerned about the 800,000 mortgage holders on fixed rates yet to feel the full brunt of increasing rates.

Assistant Treasurer Stephen Jones said households wanted to know the pain they were feeling was going to have an end, as he rejected coalition criticism he had undermined the central bank’s independence by making public comments on interest rates.

“I’m unequivocally on the side of households who are doing it tough and on the side of small businesses who are doing tough,” he told Sky News.

The future of the Reserve Bank’s leadership has also come under question ahead of the treasurer’s decision on whether to extend his term in the second half of 2023.

Several MPs, including Labor backbenchers, have questioned Dr Lowe’s tenure based on the RBA’s predictions issued during the COVID-19 pandemic that interest rates would not rise until 2024.

Treasurer Jim Chalmers has refused to comment on Dr Lowe’s future as governor.

Mr Fraser said the Reserve Bank had built up substantial trust and credibility with the Australian public during the past three decades, but the “miscalculation or misjudgement” on the forecast had jeopardised that reputation.

“Those people who are acting on that forecast have been severely burned … and that has … damaged credibility,” he said.

“That is a worry because the independence of the central bank and the credibility of the central bank is absolutely essential.”

The RBA is also subject to an independent inquiry, with the findings due next month.