Japan warns Queensland’s breach of trust could hit trade

The Queensland Government has been thrown back into a diplomatic brawl after Japan’s ambassador said the recent hike in coal royalties had the potential to dilute the trust between the two countries and impact future negotiations over hydrogen exports and other industries.

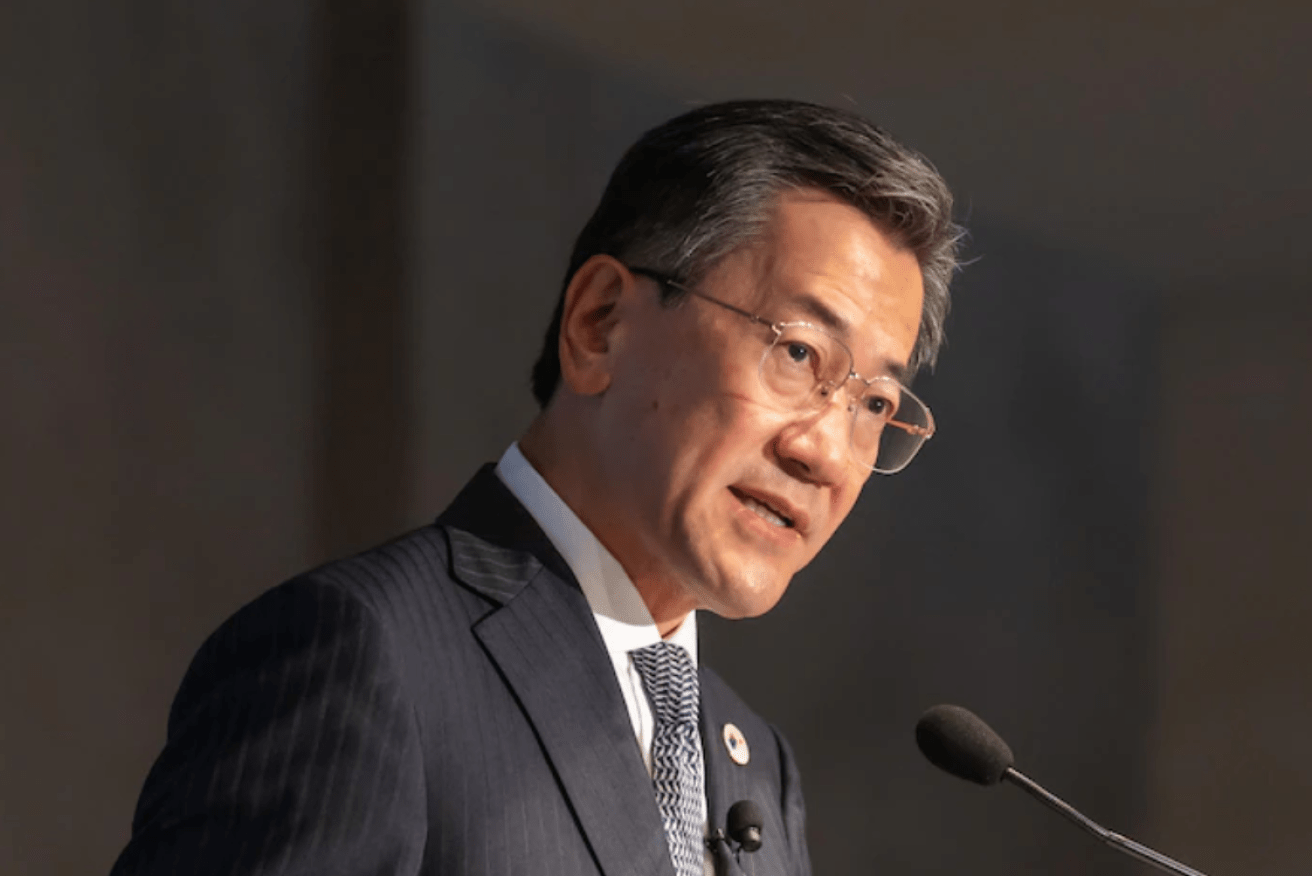

Yamagami Shingo has made an extraordinary attack on Queensland's coal royalties during a speech at University of Queensland.(Perth USAsia Centre: Kelly Pilgrim-Byrne/ABC)

Japan’s ambassador to Australia Shingo Yamagami said it must be stressed that the willingness of Japanese businesses to partner with their Australian counterparts in new areas, such as hydrogen, was underpinned by trusting Australia as a safe place to invest.

He said the mutual trust between business and government brought economic and strategic benefits.

“Japanese companies see Australia not as a house, but a home,” he said.

“This is why the decisions like the Queensland Government’s coal royalty hike carry so much potential risk. I stand by my comments that the royalty hike has affected the trust Australia has built up with Japanese investors.

“It could have implications beyond Queensland or the coal industry affecting investment in joint ventures such as the hydrogen I mentioned earlier.

“Indeed the Queensland Government’s announcement sent shockwaves through Tokyo, causing a drop in the trading price of one of the Japanese trading companies.

“There was no prior consultation between this State Government and the mining industry when these measures were taken.

“Consultation is of utmost importance.

“What they (Japanese companies) are saying was they are willing to contribute to the local economy and that’s what they have been doing.

“This time, without consultation with the companies … they increased the highest rate from 15 per cent to 40 per cent.

“It shocked them like a bolt out of the blue. They would have gone along with some increase or measures like the infrastructure fund. They are willing to make a contribution.

“Last month, I met with Premier Annastacia Palaszczuk and encouraged the Queensland Government to engage in consultation with Japanese companies in the state. Not long after, the Treasurer Cameron Dick conducted a face-to-face meeting with Japanese businesses.

“While this is a step in the right direction a lot remains to be done. Japan will continue to follow this issue closely.”

He said coal and gas formed a cornerstone of the relationship between the two nations and Japan was watching carefully the consultation underway in relation to the gas shortage in south eastern states.

“We appreciate the concern and acknowledge the necessity to take measures to ensure energy for industry affected as well as everyday lives of people in the most populated parts of Australia,” he said.

He said he had met with the Federal Government ministers Don Farrow and Madeleine King “and made the point that Japan does not want the flow of LNG from Australia to Japan to be impacted negatively.

“I was glad to hear both Ministers reassure that Australia will remain a trusted reliable energy exporter to Japan.”

The comments came as shares listed coal companies rocketed again. Bowen Coking Coal opened 6 per cent higher, Terracom jumped another 4.5 per cent, New Hope shares were up another 5 per cent this morning. Stanmore Resources, which produces mostly coking coal, was up 3 per cent.

Whitehaven is about 218 per cent for the year.

It follows an increase in thermal coal prices to $US440 a tonne after Russia extended the shutdown of its supply of gas into Europe.

The share price surge is also feeding into the debate about coal royalties in Queensland after the Government introduced new tiers of royalties which would dramatically increase the cost to coal producers.

The Government has maintained that it was a strategy to give the Queensland public access to the enormous amount of cash being generated by the state’s coal.

However, BHP’s economic contribution report released today showed that it contributed $80 billion to the Australian economy in 2022. That included $2 billion in royalties in Queensland and $5.6 billion to suppliers.

BHP asset president Mauro Neves said the company was seeing strong, long term demand from global steelmakers for Queensland’s high quality coal.

“However, we need a resturn to a reasonable, sustainable and predictable operating environment so we have the certainty and confidence to make new investments in Queensland,” he said.

“By nearly tripling the top end of royalties the Queensland Government has significantly increased the sovereign risk associated with the state.”

The State Government has been approached for comment.