BoQ profit jumps to $369 million but investors dump shares

Bank of Queensland profit has soared 221 per cent to $369 million for the year as business and home lending surged.

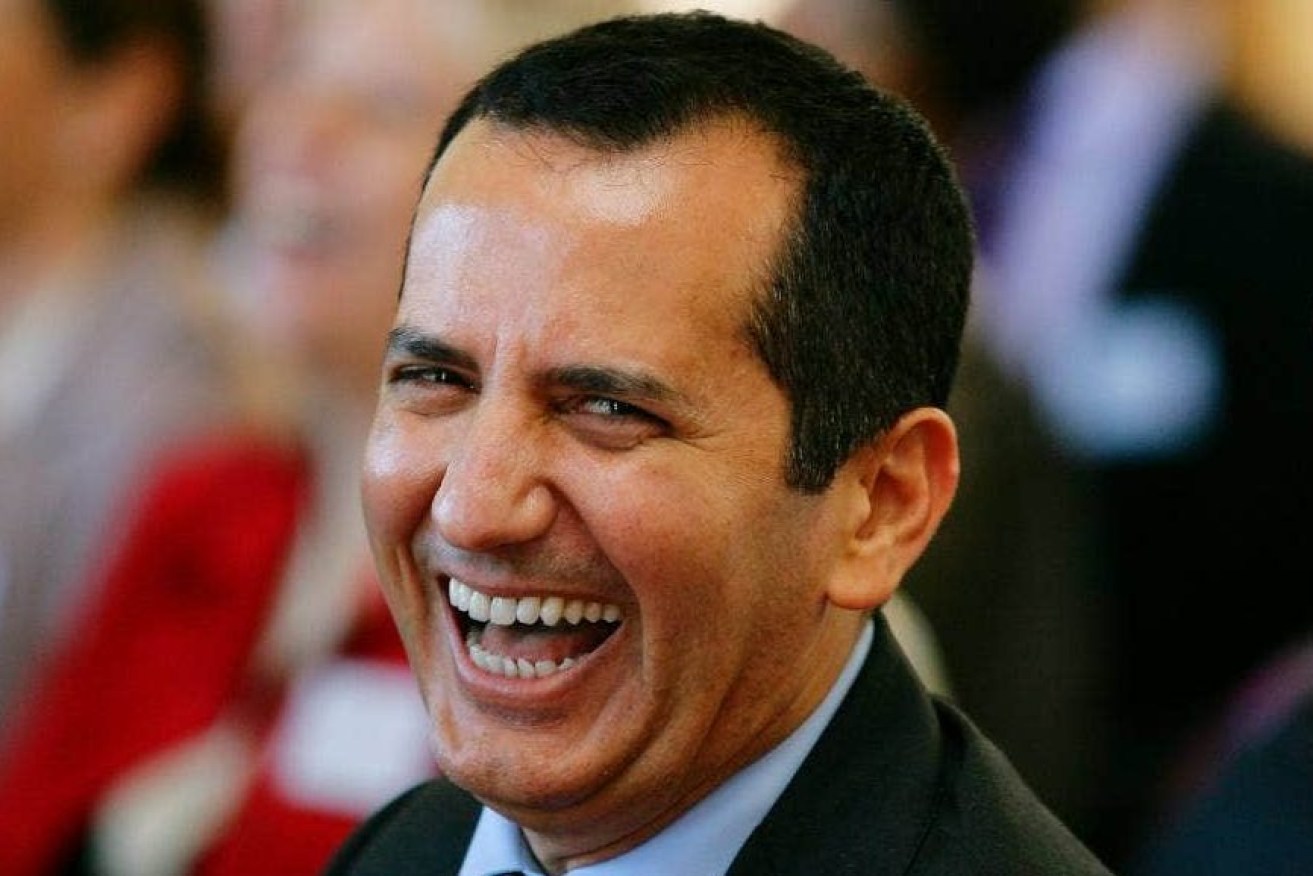

Bank of Queensland managing director George Frazis will be replaced after three years in the role. (file image)

But the company’s shares fell by 9 per cent this morning on the back of the announcement.

The result was a 221 per cent jump on the previous year and the company said business lending was up $600 million for the year as market conditions improved.

Housing growth was also 1.7 times the system growth and overall lending and advances totalled $75 billion in the year.

Shareholders will get an improved 22 cents a share dividend and 74.7 cents for the full year, an increase of 51 per cent on the previous year.

Total income for the bank was $1.26 billion, but excluding ME Bank it was $1.18 billion. The company was also able to write back $21 million from its loan impairment provisioning.

Managing director George Frazis said that despite uncertainty the bank was cautiously optimistic about the future because Australia was well placed to for economic recovery.

Frazis predicted continued growth in house prices and solid growth in consumer spending and business investment.

He said the bank expected at least 2 per cent “jaws”, a measure used to demonstrate income growth versus expenses growth. This would come from growth in its BoQ and Virgin Money brands.

“We expect the net interest margin to decline by 5 to 7 basis points in full year 2022 as competition continues and the low interest rate environment remains.

“We expect expenses to grow by 3 per cent on an underlying basis to support business growth, which will be offset by accelerated integration strategies.”

He said the integration of ME Bank was well progressed.