Budget impacts loom as coal prices plunge to four year lows

Metallurgical coal prices have plunged below $US100 a tonne to the lowest level in four years, signalling big problems for the State Government’s upcoming budget and for the industry.

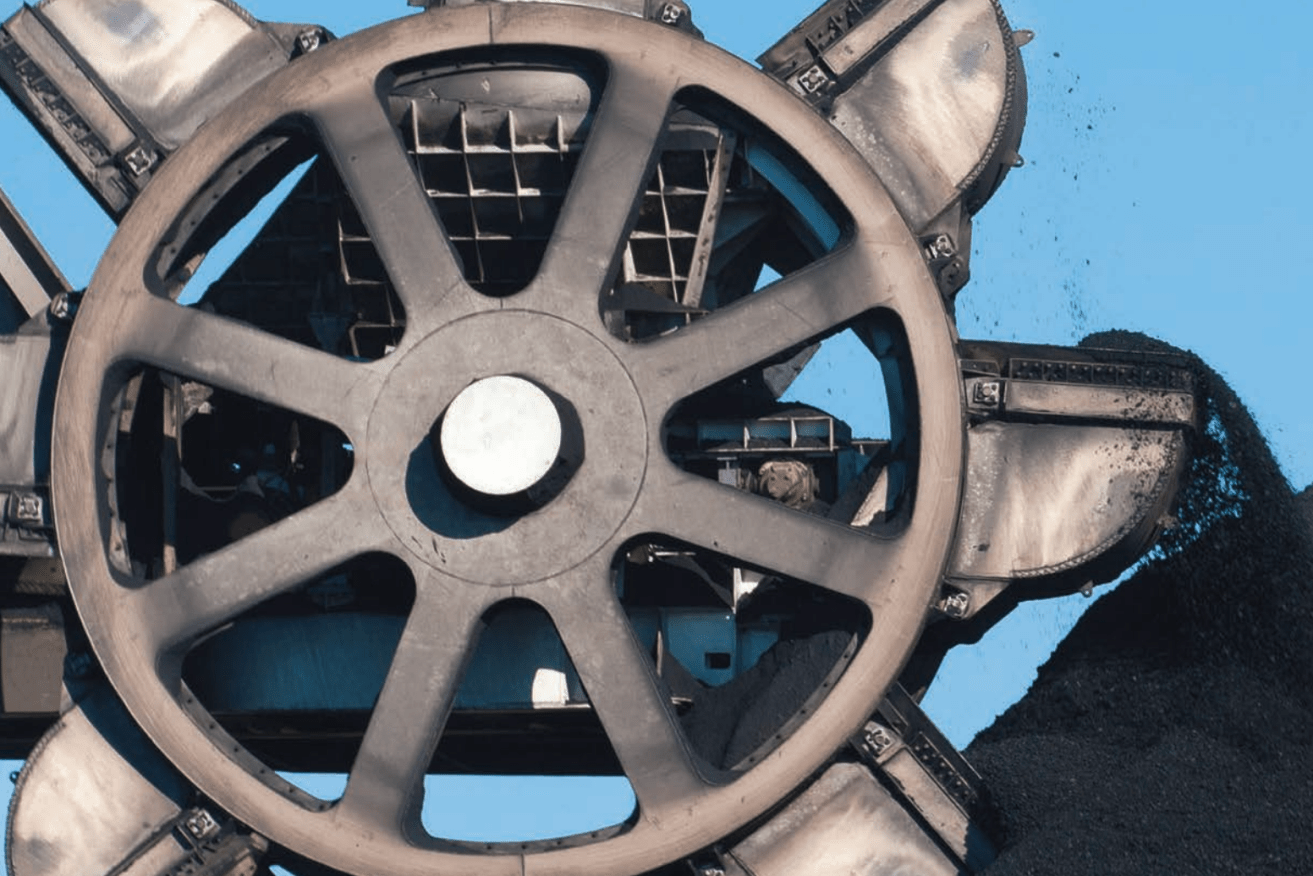

Emissions from the Bowen Basin could be dramatically reduced

Prices for coal have fallen about 30 per cent in the year to date and 15 per cent in the past month, according to RBC Capital Markets.

The Queensland Government received $3.5 billion in coal royalties last year but has been anticpating a significant fall this year. Its royalty is structured on the price received and increases in percentage terms at certain dollar values.

Most Queensland coal producers sell on a contract price which would differ from the spot market. BHP is one of the few that takes the spot price and that price was being impacted by the China’s ban on Australian coal.

RBC Capital Markets said there was demand for imported met coal in China, backed by a booming steel industry, but China was looking elsewhere for its coal, and is facing issues with limited supply from Canada, the US and Mongolia.

“On the supply side, IHS data shows a sharp uptick in coal throughput at Australian ports, while CRU reports weaker than expected production in Russia,” RBC Capital Markets said.

In its fiscal update, Queensland Treasury said energy and industrial production had been negatively impacted across Queensland’s key export markets, resulting in significantly lower export prices for key commodities.

Meanwhile, sharply lower crude oil prices (to which LNG contract prices are linked) are expected to impact petroleum royalties from 2020-21.

“The lower than expected royalty revenue in 2019-20 is primarily driven by lower coal export volumes and prices.

“Revenue from royalties and land rents is expected to fall by a further $1.531 billion in 2020-21, reflecting a downward revision of $1.433 billion (31.5 per cent) from the mid-year fiscal and economic review forecast.

“This is driven by lower coal prices and volumes, reflecting continued weaker global economic growth, as well as the recent sharp fall in oil prices flowing through to LNG values.”

RBC Capital Markets has predicted the coal price would rebound to $US140 a tonne this year and $US150 long term.

For each 1 cent movement in the Australian-US exchange rate, the impact on royalty revenue would be about $74 million in 2019-20. A 1 per cent variation in export coking and thermal coal volumes would lead to a change in royalty revenue of approximately $37 million.